Quest for Value

Mutual Fund “Ohbune”

Our Business

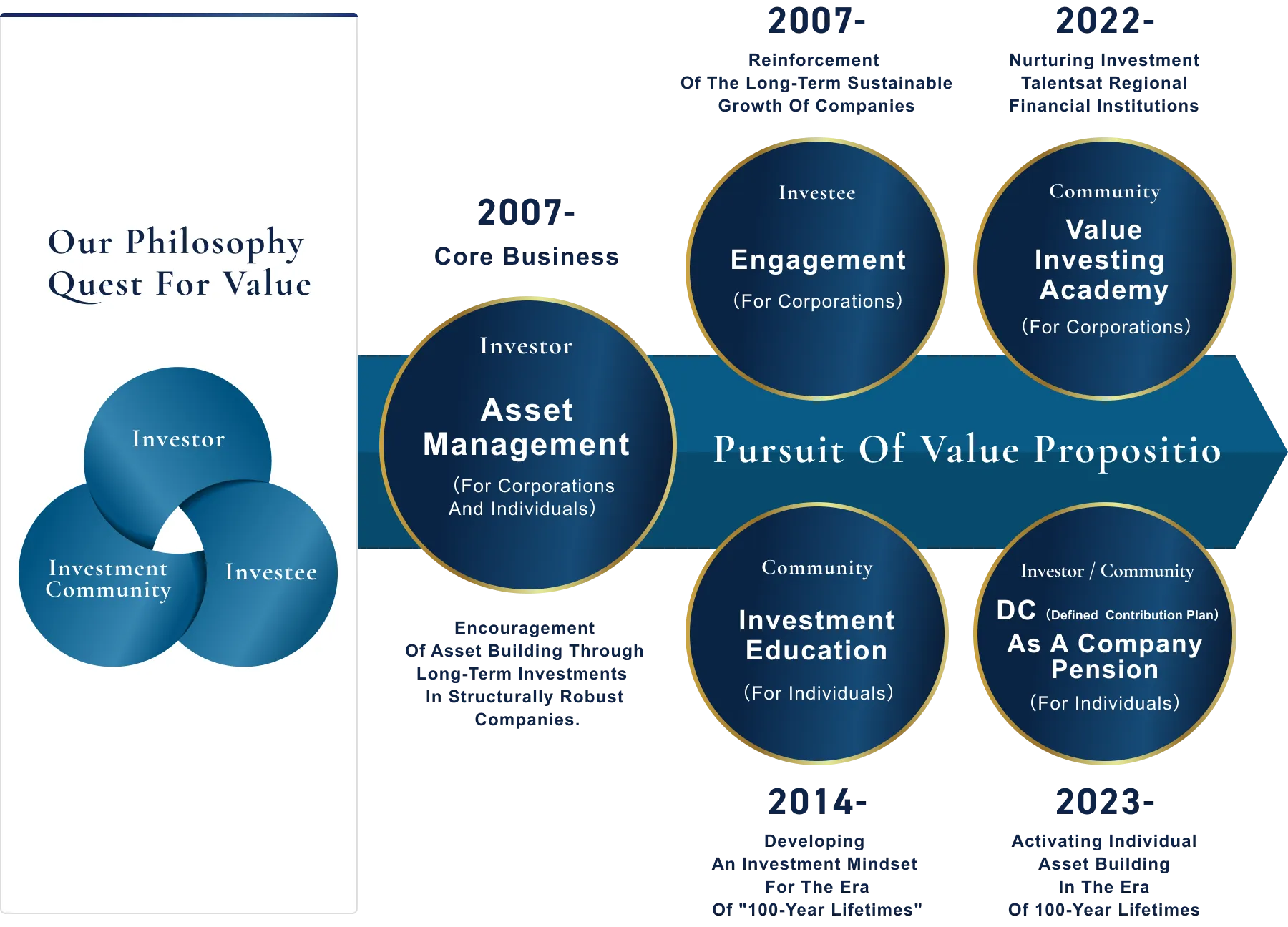

Our company was established with an aim to realize a finacial well-being through long-term capital allocation into “Structurally Robust Companies”. Based on this philosophy, we have conducted diversified business expansion centered on long-term concentrated investment, which could not only deliver the value to our clients but also increase their corporate value in the long run. Therefore, we provide value to society, companies, and individuals.

Since 2007, we have embarked on the challenge of long-term concentrated approach to equities, and based on this, we pursue value provision in five different businesses. As an asset management company supporting long-term asset building in Japan, we will continue to fulfill a diverse social role.

Asset Management

Our core business, asset management, originally structured as an internal fund at The Norinchukin Bank in 2007.

At that time, there were no funds in Japan that has the long-term concentrated investment style like us, and many people around them expressed skepticism.

However, after the Lehman Shock in 2008, the returns of the funds we managed exceeded those of other actively managed funds for Japanese stocks, and since then we have continued to build our track record, gaining recognition from institutional investors.

Based on the investment philosophy and methods,which have a proven track record in investing for institutional investors, since 2018, we have also released the “Ohbune” fund series to individual investors.

Engagement

While engagement and dialogue with companies are currently attracting attention, our company has been continuously engaging in communications with our investment targets and excellent companies overseas in terms of corporate value enhancement since our time at the Norinchukin Bank in 2007. Dialogues with us often become good triggers for the companies we invest in to improve their businesses. Recently, as indicated by the Tokyo Stock Exchange’s requests in March 2023 for “Action to Implement Management that is Conscious of Cost of Capital and Stock Price”, listed companies, in particular, are increasingly required to manage with mind set for corporate value. In this context, we believe that our accumulated insights for engagement could play a significant role in enhancing their businesses and their value as well.

Investment Education

Under the belief that “developing human resources is the best long-term investment”, we have been focusing on investment education primarily for students. Since 2014 at Kyoto University, we have been conducting donated lectures featuring prominent figures from the economic sector. Additionally, along with the mandatory inclusion of financial education in high school home economics classes from April 2022, we have independently developed financial education teaching materials and are providing them free of charge to high schools nationwide, thereby contributing to the development of the investment community.

Value Investing Academy

In a low-interest environment, the challenge of cultivating unrealized gains through long-term investment has become a management issue, especially for regional financial institutions where lending business is struggling to grow. On the other hand, Japan’s financial sector has traditionally had a strong focus on pursuing short-term returns, and the practice of long-term investment is not sufficiently established.

Nurturing investment talents with the skill set for making long-term investments by discerning the true strength and business viability of companies has become a particularly important issue for regional financial institutions. To solve this challenge, we support the skill enhancement of bankers for long-term investments through the “NVIC Value Investing Academy”.

DC(Defined Contribution Plan) as a company pension

If you have any questions or inquiries for us, please feel free to contact us.

Investment Philosophy

Long-term Investment

The source of our investment returns is the increase in corporate value, not the buying and selling of stocks. Therefore, we focus on corporate value, not stock price. In making investments, we identify the few “structurally robust companies®” that can sustainably increase their corporate value, carefully evaluate their value, and make “long-term concentrated investments” that we continue to hold.

Investment Philosophy

Long-term Concentrated Investment

Investment returns result from increases in intrinsic corporate value, instead of the trading stocks. We focus on the corporate value of a target company, not on its daily stock price. We invest in a limited number of “structurally robust companies®” that are capable of sustaining the enhancement of their corporate value. We identify companies with the potential to enhance their value over a long term, carefully analyze their corporate values, and continue to hold the stock once invested.

Investment in “Structurally Robust Companies®“

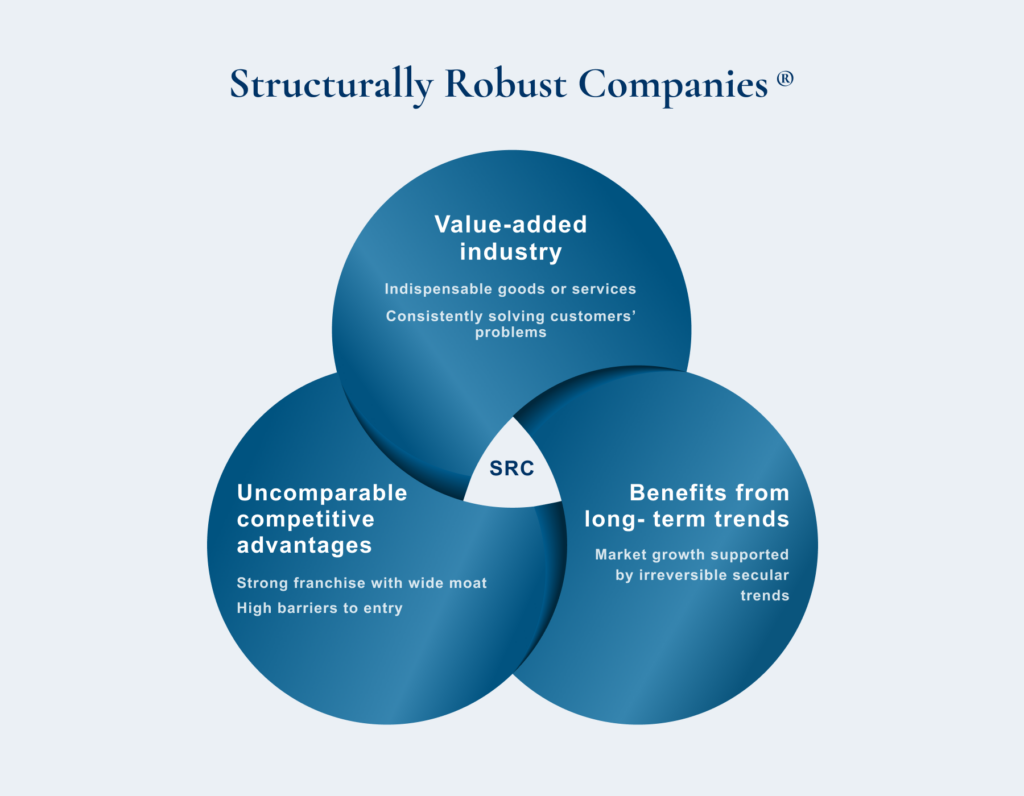

We invest in “structurally robust companies®” that are capable of generating sustainable company value over the time.

A company can be considered to be “structurally robust”, if it is an indispensable player in its industry, if the absence of the industry itself would cause severe disruption in the global economy, and if it has capability to generate sustainable cash flow behind its industry structure profile and competitive advantage.

How to Select “Structurally Robust Companies®”

The process of selecting “structurally robust companies®” is distinctly different from the conventional method of country and sector based stock screening. Through the comprehensive understanding of industrial structure by continuously asking the question of “what is the value for customer”, we evaluate the company competitive advantage. As a result, we can reach finding out “structurally robust companies®”.

We are pleased with the strong investment performance achieved since February 2009, when we started

this business at Norinchukin Trust and Banking Co., Ltd. We firmly believe that this favorable performance is

a direct result of our ability to carefully identify companies that can enhance their corporate value on a

long-term basis.

Our performance is distinguished by three key characteristics.

High Absolute Return

First, we have earned “high absolute returns”. As exhibited in the below chart, our investment return on Japanese companies alone has been on, or above par, with overseas equity investments. We believe that this result reflects the steady appreciation in corporate value of “structurally robust companies®” even from Japan that can compete in the global marketplace.

Resilience to Downside Risk

Second, our investments have shown “resilience to downside risks”. We have experienced several macroeconomic shocks, including the Great East Japan Earthquake and European financial crisis. However, even during these downward market trends, the magnitude of the stock price decline of the “structurally robust companies®” in which we invested was considered to be limited. This is because our portfolio companies play indispensable roles in the global economy.

Low Standard Deviation

Third, the stock prices of the companies in which we invest have exhibited “low standard deviation”. In general, investment in a concentrated portfolio consisting of a select number of companies involves higher risk than a diversified portfolio. However, this has not been the case for our portfolio. The financial results of our portfolio companies have proven to be structurally robust. Therefore, the standard deviations of their stock prices have remained low.

What makes it different from others?

The primary objective of the funds we are involved in managing is to support the long-term asset building of our investors. In order to achieve this objective, we use an investment approach that focuses on companies that can sustainably increase their corporate value and reap the benefits of this increase in value over the long term, rather than continuously accumulating profits through short-term trading. The table below shows the difference between our approach and that of investment firms that mainly focus on so-called short-term trading.

| NVIC | Other asset management firms | |

|---|---|---|

| Purpose of investment | Support for long term asset formation of investors | Maximization of returns in a limited period |

| Approach | Investment in companies that generate profits in the long-term | Short-term stock trading |

| Investment period | Perpetual (hold as long as possible) | Several months (because they see quarterly financial results as important) |

| Liquidity risk | Long-term investment: Become a company owner | Short-term trading: Profit from stock trading |

| Number of investment companies | 20 – 30 companies | Hundreds of companies |

Our Uniquness

16years Track Record

We have a long track record since 2007 as a pioneer of long-term concentrated investment. Even when the stock prices of portfolio companies have fallen sharply, such as in the wake of the Lehman Shock and the Great East Japan Earthquake, we have continued to hold (and in some cases buy more) without panicking. As a result, the stock prices of our portfolio companies have recovered and continued to grow over the long term. This track record is one of our major strengths, and we believe it will give us an advantage even if long-term investment becomes the norm.

Human resources capable of practicing long-term concentrated investment

Many of our analysts have backgrounds in lending at banks, consulting, and private equity funds. Because they have been involved with companies in the form of loans and have already acquired an attitude of facing the essence of the business, they have a very high affinity for long-term concentrated investment.

In addition, our senior members have not only experience as bankers, but also in-depth knowledge and experience in capital markets, and we are able to share this combined knowledge and experience with our entire team. Currently, there are only a very limited number of funds that are engaged in long-term concentrated investment, and we believe that there is a small pool of human resources who can handle this type of investment approach.

If you have any questions or inquiries for us, please feel free to contact us.

Investment Approach

Our company analysis is not primarily focused on finding companies with temporary stock price appreciation. Our focus is on identifying companies that continue to achieve superior performance over the long term.

We believe that the “structurally robust companies🄬” in which we invest have common business characteristics that transcend industry boundaries. For this reason, we do not have an industry-specific analyst system, which is common among other asset management firms, but rather have all analysts work as generalists to identify and analyze business characteristics across industries.

Team composition and analysis style

While most asset management companies have separate teams for analyzing Japanese and overseas companies, we have the same team for all of our analyses. In fact, the accumulation of analysis and dialogue with overseas companies that we have conducted since 2012 has become an invaluable asset, and has been very beneficial in terms of comparing business models with Japanese companies and analyzing the competitive advntages.

All analysts work on an analytical style and format based on a common investment philosophy. More than a dozen analysts analyze companies based on this methodology, and the analysis results are shared and discussed with the CIO and the entire investment team in a timely manner. Finally, the investment policy for each company is discussed at a portfolio management meeting consisting of the CIO, Mr. Okuno, and senior research analysts, and the investment ratio for each company is determined by Mr. Okuno’s judgment.

The quality of analysis is further deepened by sharing information with the entire investment team and discussing with each analyst’s knowledge of the company and its industry, rather than having only the analyst in charge and the CIO share information on each company. Moreover, by using a common reference point for judgment, the variation in information and differences in interpretation among analysts are minimized, and consistency in their analysis is maintained. As a result, investment decisions can be made based on accurate information, contributing to an overall improvement in investment quality.

Analyzing companies using our own feet and eyes

One of the hallmarks of our analysis of companies is that we use our own eyes and feet to see what is happening on site. Throughout our long business history, we have recognized patterns of structurally robust companies®. Based on these patterns, we first thoroughly analyze a company’s financial statements, presentation materials, and industry trends, and then read the strength and stability of the company from its numbers and qualitative information. However, our analysis does not end with numbers. We actually visit the site and verify our hypotheses.

Hypothesis testing during company visits

We formulate hypotheses based on our analysis of company and industry figures and qualitative information, and then test these hypotheses directly through actual company visits. We not only visit potential investment targets, but also competitors and companies in surrounding industries that come to our attention in the course of our analysis to help support our hypotheses. This process is repeated to accurately grasp the added value of the business, its competitive advantage, and the true value of the company, and it is no exaggeration to say that one of NVIC’s most distinctive features is its emphasis on dialogue not only with IR personnel but also with management, during which in-depth discussions of the company’s business and strategy are developed.

Inspection of the factory

Especially in the case of manufacturing companies, we actually visit their factories to see firsthand the manufacturing process and factory conditions. This process gives us a sense of the company’s commitment, strengths, and direction that cannot be obtained from financial results.

Investment Commentary

The CIO including the analyst will regularly output analytical perspectives and insights gained in the field of corporate analysis, as well as themes and topics related to equity investment.

- Investment Commentary “Okunohoshomichi Issue #1

- Investment Commentary “Okunohoshomichi Issue #2

- Investment Commentary “Okunohoshomichi Issue #3

If you have any questions or inquiries for us, please feel free to contact us.

Message from CIO

In 2007, at The Norinchukin Bank, we launched an in-house project involving “long-term concentrated investment”. It was a distinctive move among Japanese institutional investors and provided a sharp contrast to today’s stock market. This is because our investment approach was unique in that we aim to generate returns arising from increases in the value of corporations that we own, rather than from dealing stock certificates being circulated in the market.

Since then, we have endured challenging market environments and witnessed an extraordinary series of events which could have ruined the market, including the Lehman shock, European financial crisis, and Great East Japan Earthquake. Through significant efforts, we have steadily honed our expertise in corporate valuation. Even within such a volatile stock market, the long-term competitiveness of the “structurally robust companies” in which we invested has not deteriorated. Consequently, we have consistently achieved favorable returns.

We understand that it is still premature for us to attempt to justify our “long-term concentrated investment” approach. Nevertheless, we feel strongly that an essential function of the capital market is for investors to cope sincerely with enterprise values and make a long-term commitment to their growth. As professionals in finance and investment, we embrace the opportunity to play such a meaningful role. All of our investment team members feel strongly that such a mission is both challenging and fulfilling.

Moving forward, as we utilize a precise yardstick to measure enterprise values, we will ensure that each of our members endeavors to continuously sharpen their ability to evaluate companies, which is our core competency, while proactively and creatively pursuing their full potential as individuals. We are committed to contribute to the enhancement of corporate values through optimal capital allocation and to achieve sustainably stable returns (alpha“α”), regardless of fluctuations in the market.

Kazushige Okuno

Managing Director, CIO

Profile

Corporate Profile

| Company Name | Norinchukin Value Investments Co., Ltd. |

| Established | October 2, 2014 |

| Head Office | Hibiya Kokusai Building 14th floor, 2-2-3, Uchisaiwaicho, Chiyoda-ku, Tokyo, 100-0011 Japan |

| Phone | 81-3-3580-2050 |

| Representative Directors | Naohide Sakemi |

| Capital | 444 million Japanese Yen |

| Capital reserve | 444 million Japanese Yen |

| Major Shareholders | 64.75%: The Norinchukin Bank 27.75%: The Norinchukin Trust and Banking Co., Ltd. |

| Business | Type II Financial Instruments Business, Investment Management Business and Investment Advisory |

Management

| President | Naohide Sakemi |

| Managing Director (CIO) | Kazushige Okuno |

| Director | Ryusuke Sueda |

| Director | Seijiro Yamazaki |

| Director | Yukou Yasuda |

| Director | Kiyofumi Tamei |

| Director | Susumu Miyaji |

| Director | Masakuni Arakawa |

| Audit & Supervisory Board Member | Hiroaki Suzuki |

| Corporate Officer | Hitoshi Miyajima |

| Corporate Officer | Tohru Horino |

| Corporate Officer | Chikara Kamisuki |

| Corporate Officer | Masaki Nagahara |

| Corporate Officer | Akihiro Ohta |

MAP

If you have any questions or inquiries for us, please feel free to contact us.