Okunohosomichi Issue #3 – “Strength of a company” from the standpoint of long-term investment

We published the following article five years ago, in August 2010, while at the Norinchukin Trust Banking Co., Ltd., but its contents remain just as valid today. This vividly demonstrates the fact that our investment analysis from a long-term perspective is based on fundamental principles that are universally applicable.

The theme of this issue is the “strength of a company”. We would like to discuss this theme in terms of “exceptional underlying economics”, a concept which Mr. Warren Buffett emphasizes.

Mr. Buffett characterizes the organizations in which he invests as “companies with exceptional underlying economics”. When we evaluate the strength of a company, the analysis should encompass a wide variety of factors, such as technology, marketing, management capability, and business strategy. Among them, Mr. Buffett pays special attention to exceptional underlying economics that a company possesses.

What are “exceptional underlying economics”? Using the convenience store industry as an example, we would like to explain, as our hypothesis, how differences among convenience store chains arise in their underlying economics.

We think that underlying economics distinctively differ across convenience store companies, although they seem to deliver seemingly similar products and services through their 24-hour operations. In our opinion, 7-Eleven Japan has far more exceptional underlying economics than its competitors.

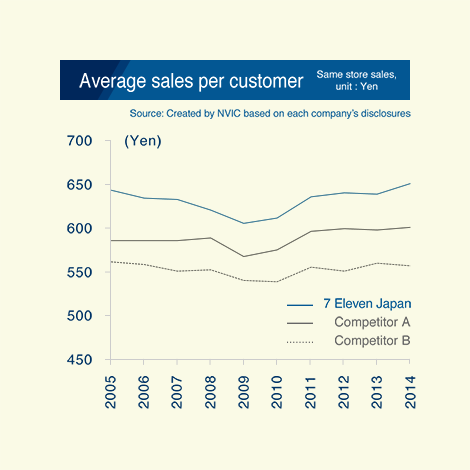

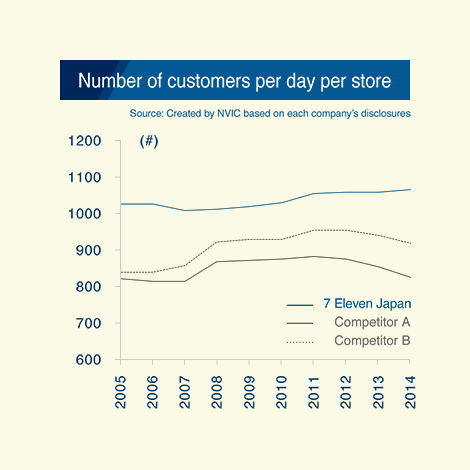

The tables below show “average sales per customer” and “number of customers” respectively. 7-Eleven Japan outnumbers competitors in both analyses. Furthermore, the superiority of 7-Eleven is not just a short-term phenomenon, but has continued over a long period of time. What brings about such a sustained difference?

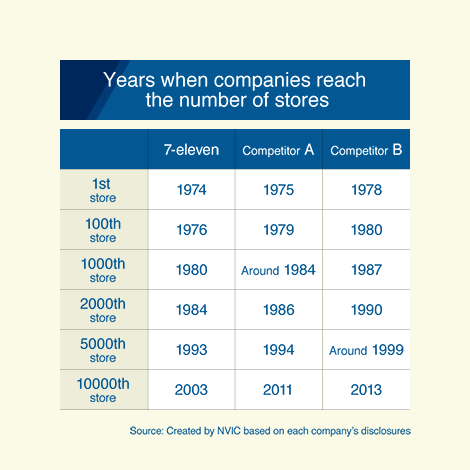

Now, let’s briefly look at the history of store expansions of convenience store companies.

Based on the tables above, we believe that we can present the following hypothesis to explain the distinct differences among convenience store companies in terms of average sales per customer and number of customers.

Our hypothesis:

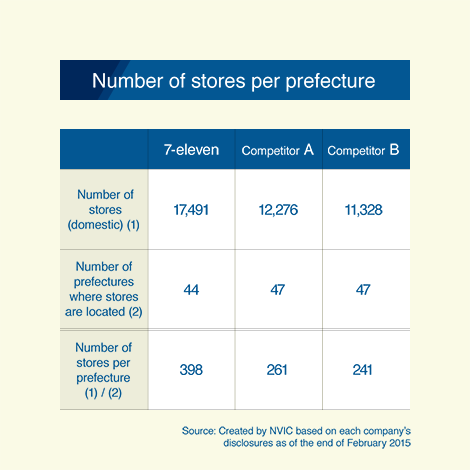

7-Eleven Japan has historically moved ahead of competitors in its efforts to increase its franchised stores and deter rivals from expanding. It has succeeded in aggressively opening stores which are concentrated in good locations, while its rivals who started later, had to look for remaining suitable locations all around Japan, but ended up securing franchised stores that were geographically dispersed.

7-Eleven has achieved a “concentration of stores in good locations” over a long period of time. Based on the hypothesis that the key to a successful retail business lies in establishing efficient logistics, we believe that this “underlying fact” of “concentration of stores in good locations” brings about exceptional economics for a retail business, such as strong results in average sales per customer and customer volumes. Though businesses operated by convenience store chains seem similar when we first examine them, the reality is that distinctive differences exist in their “underlying economics” that are deeply rooted in their history and, thus, cannot be easily changed.

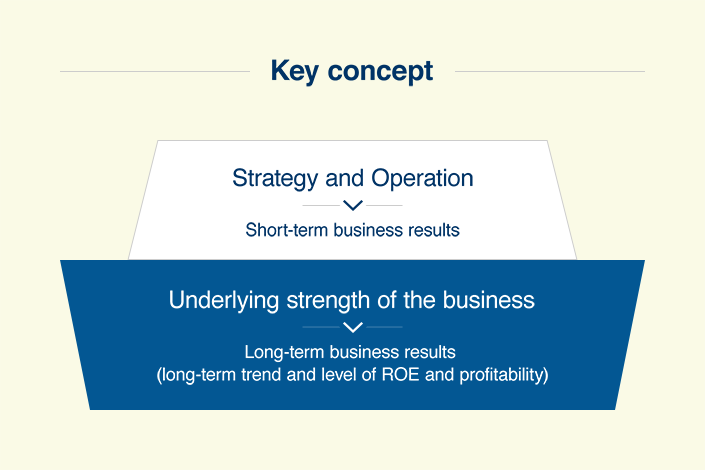

Competitors who lagged way behind 7-Eleven are struggling and making various efforts, including opening new types of convenience stores, developing innovative products, and appointing talented management teams. These efforts on a business strategy level could impact business results in the short-term. However, they are unlikely to change the realm of underlying strengths that form their business foundation.

This point is eloquently expressed in Mr. Buffett’s quote “A good managerial record is far more a function of what business boat you get into than it is of how effectively you row.”

There should be many elements which measure “strength of a company”. Among those elements, we would like to analyze a company by paying special attention to “exceptional underlying economics” that define their long-term business performance.

1 Okunohosomichi was originally the title of a journal, and one of the major texts of classic Japanese literature, “The Narrow Road to the Deep North” published in the early 18th century. We chose this title as we think the title “narrow road” represents the challenging nature of investing and because the first part of the title is the same as the name of NVIC’s CIO, Kazushige Okuno.

Disclaimer

The information contained in this material is for general informational purpose only and shall not be construed as an offer or solicitation to subscribe in the funds, products or securities referred herewith or to conclude an investment advisory agreement or discretionary investment management agreement. Our clients consist exclusively of corporations engaged in the investment management business.

Company Name: The Norinchukin Value Investments Co., Ltd.

Financial instruments firm Director of Kanto Local Finance Bureau (Kinsho), Registration No. 2811 Fee Matters: We charge our clients for our investment advisory services Management Fees and Performance Fees, each of which will not exceed the following respective amounts per annum:

Management Fee: 3.24% (including tax) of the amount of assets under management

Performance Fee: 32.40% (including tax) of the excess profit amount over an agreed upon hurdle rate

Risk Matters: The prices and values of investments, including securities, on which we provide investment advice will vary, depending on fluctuations in the securities markets, foreign exchange rates, interest rates, and other factors, and accordingly the value may be less than the original investment amount, resulting in loss. With respect to derivatives transactions, the amount of such loss could exceed the margin deposits.

Membership in Association: Japan Investment Advisers Association The information contained herein has been obtained from sources deemed reliable; however, we make no guarantees as to the completeness or accuracy of the information.

The opinions in this document include the author’s individual view, which may not necessarily be that of our company.