Okunohosomichi Issue #1 – Investment in businesses we can understand

This commentary has been issued periodically at The Norinchukin Trust and Banking Co., Ltd. when we were engaged in this business. Now, at the launch of Norinchukin Value Investments Co., Ltd. (NVIC), we would like to issue these again by adding new insights that we have today.We published the following article five years ago, in June 2010, but its contents remain just as valid today. This vividly demonstrates the fact that our investment analysis from a long-term perspective is based on fundamental principles that are universally applicable.

Now, let’s introduce the main topic. In this issue, we would like to discuss the theme of investing in businesses that you can understand by using the example of Nintendo Co.Ltd., a company which is considered to be highly competitive in the global marketplace.

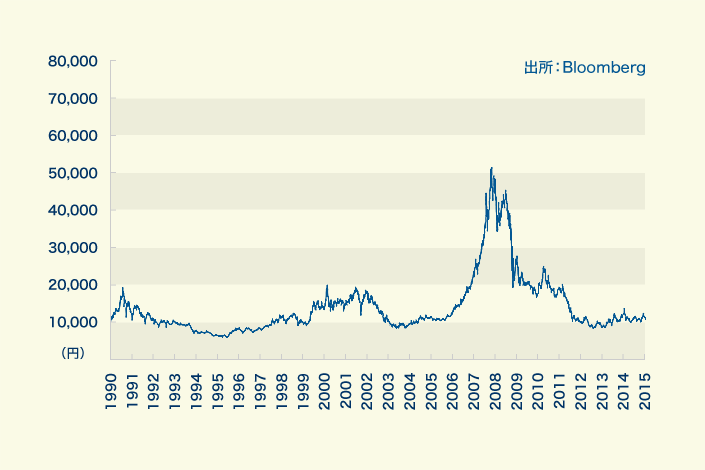

Leveraging the breakthroughs in the mid- to late 2000’s of Wii and DS, which revolutionized home video game consoles, Nintendo’s operating income reached its peak, exceeding 500 billion Yen in the fiscal year ended March 2009. However, in recent years, Nintendo’s growth strategy reached a crucial turning point, as evidenced by the fact that it has recorded losses in operating income for the past three consecutive years.

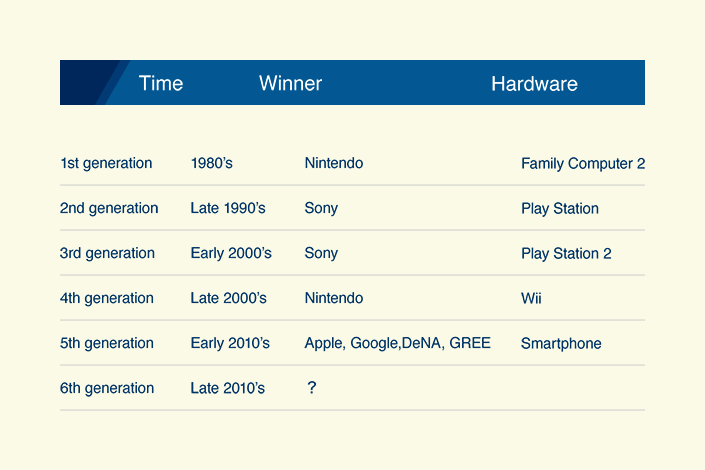

The table below summarizes how next-generation gaming platforms have evolved.

Intense competition among gaming platform manufacturers began in 1983 with Nintendo’s release of its “Family Computer Console” 3. New winners in the battle for this business have emerged in approximately five year cycles. This simple fact alone reasonably leads to the hypothesis that the gaming industry is highly unpredictable.The competitive environment surrounding today’s gaming industry has reached a hyper-competitive stage now that console manufacturers must also compete for “eyeball” share (consumers’ attention) against companies in different industries, such as Apple and Google. This situation makes it even more difficult to understand the business of game console manufacturers, including Nintendo.

Below are four criteria that Mr. Warren Buffett, uses in screening companies in which to invest.

(1) Businesses that we can understand

(2) Favorable long-term prospects

(3) Operated by honest and competent people

(4) Companies that are priced very attractively

The first and most important of Mr. Buffet’s four investment criteria is “businesses that we can understand.” We believe that he considers this to be the most important one because, if he didn’t understand the nature of its business activities, then he could not judge the economics of the business, its long-term prospects for growth, the competency of its management team, nor the attractiveness of its pricing.

In fact, while Mr. Buffett has avoided investing in companies in high-tech industries that are difficult to understand due to their rapid technological innovations, he has invested in companies with business models that are easy to understand and predict for the next 10-15 years. These include big name companies, such as Coca-Cola and razor maker Gillette, just to name a few. Who on earth could imagine a world 10 years from now in which people do not drink Coke or where men do not shave with a razor, even in the event that further technological advancement emerged that exceeded the impact of the Internet revolution?

Once we understand their sources of competitive advantage, we can forecast cash flow that will be generated from businesses and eventually calculate their corporate value with reliability. If cash flow remains unchanged from assumptions used for cash flow projections, then value investors do nothave to swing from joy to sorrow when they see daily stock market fluctuations. Rather, they can take advantage of daily movements for their own profit opportunity. In today’s marketplace, which is characterized by an external environment of perpetual change, don’t you think that concentrated investment in companies that you can understand would make you sleep better at night?

1 Okunohosomichi was originally the title of a journal, and one of the major texts of classic Japanese literature, “The Narrow Road to the Deep North” published in the early 18th century. We chose this title as we think the title “narrow road” represents the challenging nature of investing and because the first part of the title is the same as the name of NVIC’s CIO, Kazushige Okuno.

2-3 (Translator’s note) Often referred to as “NES” in western countries.

Disclaimer

The information contained in this material is for general informational purpose only and shall not be construed as an offer or solicitation to subscribe in the funds, products or securities referred herewith or to conclude an investment advisory agreement or discretionary investment management agreement. Our clients consist exclusively of corporations engaged in the investment management business.

Company Name: The Norinchukin Value Investments Co., Ltd.

Financial instruments firm Director of Kanto Local Finance Bureau (Kinsho), Registration No. 2811 Fee Matters: We charge our clients for our investment advisory services Management Fees and Performance Fees, each of which will not exceed the following respective amounts per annum:

Management Fee: 3.24% (including tax) of the amount of assets under management

Performance Fee: 32.40% (including tax) of the excess profit amount over an agreed upon hurdle rate

Risk Matters: The prices and values of investments, including securities, on which we provide investment advice will vary, depending on fluctuations in the securities markets, foreign exchange rates, interest rates, and other factors, and accordingly the value may be less than the original investment amount, resulting in loss. With respect to derivatives transactions, the amount of such loss could exceed the margin deposits.

Membership in Association: Japan Investment Advisers Association The information contained herein has been obtained from sources deemed reliable; however, we make no guarantees as to the completeness or accuracy of the information.

The opinions in this document include the author’s individual view, which may not necessarily be that of our company.