Okunohosomichi Issue #2 – Industry analysis for the purpose of long-term investment

We published the following article five years ago, in July 2010, while at the Norinchukin Trust Banking Co., Ltd., but its contents remain just as valid today. This vividly demonstrates the fact that our investment analysis from a long-term perspective is based on fundamental principles that are universally applicable.

Nowadays, we see young and old alike using iPhones not only at bars and restaurants, but also on every street corner in our cities. We can download and use applications (“apps”) at low cost, and sometimes even for free, that are developed all over the world.

By making use of my iPhone, I recognize from my own personal experiences that it is much more than just a mobile phone. Aside from the question of whether or not the iPhone has revolutionized the world, we would like to discuss cases in which technological innovation, or the emergence of a new business model, changes an industry structure or industry boundaries. Then, we would like to highlight how important it is to analyze the dynamics of an industry and business when investing over the long-term.

From a long-term investor’s point of view, the relative stability of the industry to which the investee company belongs is considered desirable.

Looking at investments made by Mr. Warren Buffett, we find that most companies belong to industries with stable structures over the long-term, such as Wrigley, See’s Candies, Coca-Cola, and disposable razor manufacturer, Gillette (which was acquired by P&G in 2005). It is safe to say that all of these industries in which Mr. Buffet invested are unlikely to experience substantial technological revolution or other events that could sway their foundation.

Thus, the question arises: How can we analyze and judge the stability and sustainability of an industry when we make investments?

In this regard, Mr. Buffett explains “With Wrigley chewing gum, it’s the lack of change

that appeals to me. I don’t think it is going to be hurt by the Internet. That’s the kind of business I like.” His comment vividly illustrates the importance of stability and sustainability, as proven by history, for long-term investment.

However, we question whether or not the mere fact that an industry has a proven track record of stability in the past is sufficient for determining if that industry will continue to be stable and sustainable in the future. This is because all industries and businesses are exposed, in varying degrees, to the dynamism of structural changes that can, at any time, be triggered by technological breakthroughs and the emergence of new business models. This is especially true in today’s business environment in which information technology is dramatically advancing and where companies that have not previously been viewed as competitors can pose unprecedented challenges that threaten your business.

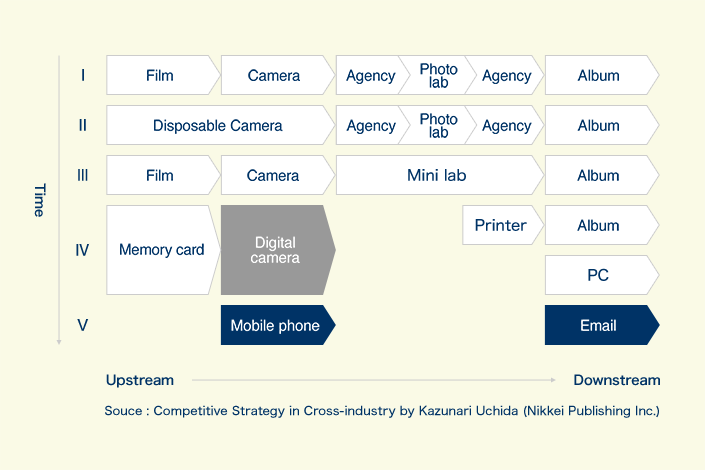

Let’s examine what happened to the camera film industry to illustrate an example of the transformation of an industry structure.

When photography was primarily done using cameras that required film, the companies that manufactured film were among the upstream players in the value chain and the camera film business was considered to be robust. However, advances in digital technology and the widespread use of personal computers led to dramatic changes in the industry: film cameras were replaced by digital cameras and photo labs were replaced by personal printers.

This history of the camera film industry is a typical example in which a seemingly stable industry and business experienced a dramatic change in its value chain due to technological innovation. Similar structural changes could happen in other industries, but perhaps to a lesser extent than they did in the camera film industry.

Do these observations lead to the conclusion that industry analysis is not useful for investment decisions?

We do not think so. Rather, we believe that it is essential to gain an in-depth understanding of the dynamics of an industry, including the possibility of structural changes in that industry triggered by technological innovation. Indeed, such changes are gradually taking place in our daily lives, unlike chemical reactions that occur instantaneously in a laboratory. We believe that we can recognize them utilizing our common sense, if we have the requisite sensitivity and ability to carefully observe things.

In conclusion, industry stability and sustainability that can be verified using dynamic industry analysis on a common sense level is one of the necessary conditions for an industry to be considered eligible for long-term investment.

1 Okunohosomichi was originally the title of a journal, and one of the major texts of classic Japanese literature, “The Narrow Road to the Deep North” published in the early 18th century. We chose this title as we think the title “narrow road” represents the challenging nature of investing and because the first part of the title is the same as the name of NVIC’s CIO, Kazushige Okuno.

Disclaimer

The information contained in this material is for general informational purpose only and shall not be construed as an offer or solicitation to subscribe in the funds, products or securities referred herewith or to conclude an investment advisory agreement or discretionary investment management agreement. Our clients consist exclusively of corporations engaged in the investment management business.

Company Name: The Norinchukin Value Investments Co., Ltd.

Financial instruments firm Director of Kanto Local Finance Bureau (Kinsho), Registration No. 2811 Fee Matters: We charge our clients for our investment advisory services Management Fees and Performance Fees, each of which will not exceed the following respective amounts per annum:

Management Fee: 3.24% (including tax) of the amount of assets under management

Performance Fee: 32.40% (including tax) of the excess profit amount over an agreed upon hurdle rate

Risk Matters: The prices and values of investments, including securities, on which we provide investment advice will vary, depending on fluctuations in the securities markets, foreign exchange rates, interest rates, and other factors, and accordingly the value may be less than the original investment amount, resulting in loss. With respect to derivatives transactions, the amount of such loss could exceed the margin deposits.

Membership in Association: Japan Investment Advisers Association The information contained herein has been obtained from sources deemed reliable; however, we make no guarantees as to the completeness or accuracy of the information.

The opinions in this document include the author’s individual view, which may not necessarily be that of our company.